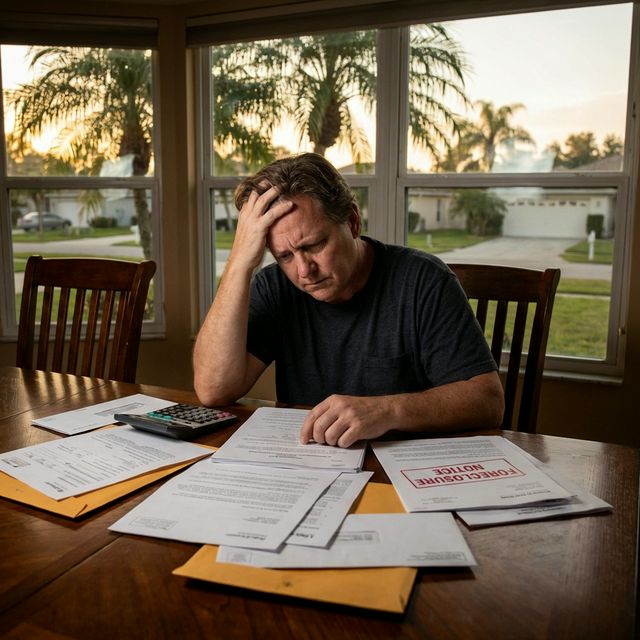

Can I Sell My House If I'm Behind on Mortgage Payments?

Last updated: February 2026

Quick Answer

Yes, you can sell even if you're behind on payments. Selling is often the best way to avoid foreclosure, protect your credit, and salvage your equity. Florida's foreclosure process takes 200-300 days—you have time to sell if you act quickly.

Your Options When Behind on Payments

Option 1: Regular Sale (If You Have Equity)

If your home is worth more than you owe, you can sell normally. The mortgage payoff happens at closing—all back payments, late fees, and remaining balance are paid from the sale proceeds.

Best for: Homeowners with equity who can wait 30-60+ days for a traditional sale

Option 2: Cash Sale (Fastest)

Cash buyers like FL Home Buyers can close in 7-14 days. This is often fast enough to beat the foreclosure timeline and get you out cleanly. We work with title companies to handle the mortgage payoff.

Best for: Homeowners who need to sell fast to avoid foreclosure

Option 3: Short Sale (If Underwater)

If you owe more than the home is worth, you may need lender approval for a "short sale"—where the lender agrees to accept less than the full balance. This takes longer (60-120+ days) and requires lender negotiation.

Best for: Homeowners with no equity who have time before foreclosure

Florida Foreclosure Timeline

Florida uses judicial foreclosure, which gives you more time:

- 30-90 days: Missed payments, late fees accumulate

- 90-120 days: Lender sends Notice of Default

- 120-180 days: Lis Pendens filed (foreclosure lawsuit begins)

- 180-300+ days: Court process, potential sale

You can sell at any point before the foreclosure sale is finalized. The sooner you act, the more options you have.

Why Selling Beats Foreclosure

- Protect your credit—foreclosure stays on credit for 7 years

- Keep your equity—foreclosure auctions rarely maximize value

- Avoid deficiency judgment—where you still owe money after foreclosure

- Move on faster—buy another home sooner without foreclosure on record

Need to sell fast to avoid foreclosure? Get a free cash offer or call (561) 258-9405.