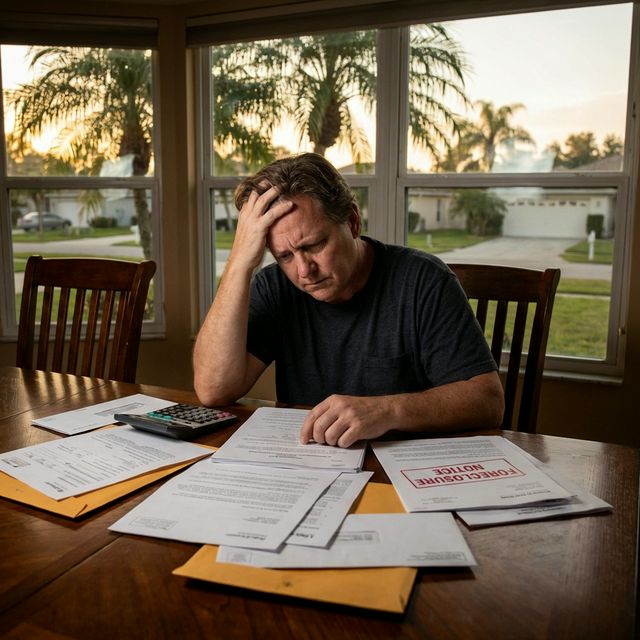

Can You Sell a House in Foreclosure?

Last updated: February 2026

Quick Answer

Yes, you can sell your house during foreclosure up until the foreclosure sale date. Florida's foreclosure process takes 200-300 days, giving you time to sell, pay off the mortgage, and avoid the credit damage. We can close fast to help you beat the deadline.

How Florida Foreclosure Works

Florida is a judicial foreclosure state, meaning your lender must go through the court system to foreclose. This takes time—typically 200-300 days from the first missed payment to the foreclosure sale. Here's the typical timeline:

Days 30-90: Missed payments

Lender sends notices and attempts to contact you.

Days 90-120: Lis pendens filed

Foreclosure lawsuit begins. Public record.

Days 120-200: Court process

Hearings, motions, and summary judgment.

Day 200+: Foreclosure sale

Property is sold at auction. You can sell before this date.

Why Sell Before Foreclosure Completes?

Selling before the foreclosure sale has major benefits:

- Protect your credit: A completed foreclosure stays on your credit for 7 years and drops your score 100-160 points.

- Get cash from equity: If your house is worth more than you owe, you keep the difference.

- Move on faster: You control the timeline instead of waiting for the court process.

- Avoid deficiency judgment: In some cases, lenders can pursue you for the shortfall. Selling may help you negotiate that away.

How We Can Help

If you're facing foreclosure, time is critical. We can:

- Give you a cash offer within 24-48 hours

- Close in 7-14 days—fast enough to beat most foreclosure timelines

- Coordinate with your lender to ensure payoff amounts are accurate

- Handle the title work and closing

If you owe more than the house is worth, we can discuss a short sale—where your lender agrees to accept less than what's owed. It's a longer process, but we've done them before and can help navigate it.

Don't wait until it's too late. Call (561) 258-9405 or get a free cash offer today.