Last updated: February 2026

What Is a Short Sale in Florida?

Last updated: February 2026

Quick Answer

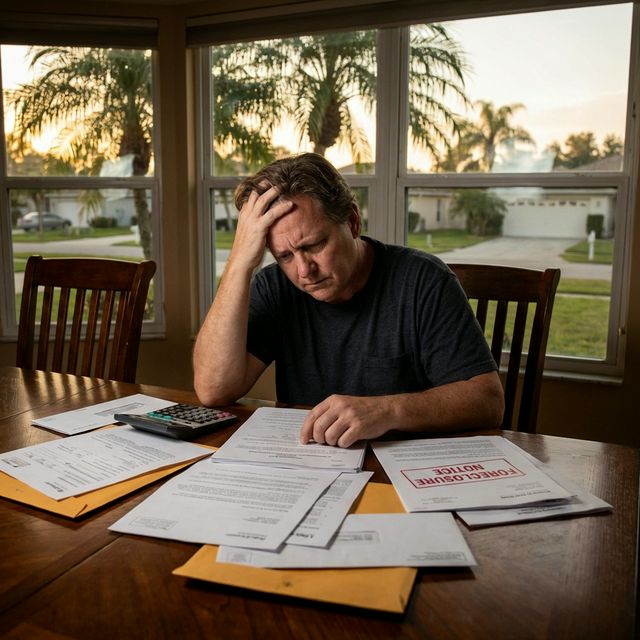

A short sale is when you sell your home for less than what you owe on the mortgage, with your lender's approval. In Florida, short sales require the lender to agree to accept less than the full loan balance. The process typically takes 3-12 months — but selling to a cash buyer before you're underwater can avoid a short sale entirely.

How a Short Sale Works

When your home's market value drops below your mortgage balance, you're "underwater." If you need to sell, your lender must approve a sale for less than what's owed. You submit a "hardship package" including financial statements, tax returns, pay stubs, and a hardship letter explaining why you can't maintain payments. The lender reviews this, gets a BPO (Broker Price Opinion), and decides whether to approve the short sale.

Short Sale Timeline in Florida

Florida short sales are notoriously slow. After listing the property and receiving an offer: initial lender review takes 30-60 days, BPO scheduling and completion takes 2-4 weeks, negotiation takes 30-90 days, and final approval can take another 2-4 weeks. Total timeline: 3-12 months. During this time, you're still responsible for property maintenance, insurance, and HOA fees.

Credit Impact: Short Sale vs. Foreclosure

A short sale is less damaging than foreclosure but still significantly impacts your credit. Short sales typically reduce your credit score by 80-150 points and remain on your report for 7 years. You may be eligible for a new FHA mortgage in 3 years (vs. 7 years after foreclosure). Florida's anti-deficiency statute protects you from the lender pursuing the remaining balance in most residential cases.

Alternatives to Short Sale

Before pursuing a short sale, consider: (1) Loan modification — your lender may reduce your rate or extend terms. (2) Selling for cash quickly before falling further behind. (3) Deed-in-lieu of foreclosure — you give the property back voluntarily, which can be faster. At FL Home Buyers, we can evaluate whether you have enough equity for a regular sale, potentially avoiding the short sale process entirely.

Related Questions

Get Your Cash Offer Today

No repairs. No fees. Close in 7-21 days.