Short version

State budget policy quickly turns into local taxes, permits, and housing pressure. The 2026–2027 proposal includes $117.4B in spending, $293.7M for housing programs, and signals on property tax relief. Here's what it means for your wallet and your home sale.

Budget Overview

On December 10, 2025, Governor Ron DeSantis released the proposed "Floridians First" budget for the 2026–2027 fiscal year.

It's a proposal. The Legislature must still approve a final version.

What Homeowners Should Ask

- Will this budget raise or lower costs in your ZIP code?

- Will it speed up or stall new housing supply?

- Will it change who can buy—and what they can afford?

Budget Snapshot

| Line Item | Amount | Why It Matters |

|---|---|---|

| Total Budget | $117.4B | Large spending can shift local demand and timelines |

| Reserves | $16.75B | Buffer against storms and economic shocks |

| Debt Reduction | $250M | Indicates a fiscally cautious posture |

Housing Allocations

The proposal highlights three housing programs:

- SHIP: $170.8M

- SAIL: $72.9M

- Hometown Heroes: $50M

SHIP and SAIL: Supply Builders

These are Florida's core funding sources for affordable and workforce housing.

More money can mean more units, but delivery is slow. Progress depends on:

- Land use policies

- Permit timelines

- Contractor availability

- Buildable insurance

- Utility hookups and impact fees

If those constraints don't ease, the money stalls. If they do, housing supply grows.

Hometown Heroes: Entry-Level Demand

This program supports down payments and closing costs for first-time buyers in key professions. It increases demand for move-in-ready, financeable homes.

But these buyers can't typically buy homes that:

- Need major repairs

- Fail appraisal

- Lack standard insurance coverage

Cash buyers tend to fill that gap. Not because of hype, but because of lending math. See how we buy houses as-is →

Property Tax Line Items

The budget includes a $300M placeholder for statewide property tax relief discussions. That's not a tax cut—it's a signal of potential action.

Counties still need revenue. If property tax adjustments happen, other costs often rise, including:

- Special assessments

- Stormwater and waste fees

- Offsetting hikes in insurance or wages

- Millage changes that hit some neighborhoods harder

What to watch:

- Final budget language

- County-level notices

- Actual impact on your property's bill

Tax Relief That Affects Homeowners

Sales tax holidays and exemptions are highlighted. These may help with household spending but won't change your mortgage, rent, or insurance.

A proposed Second Amendment Sales Tax Holiday appears in the release. It does not influence housing.

What matters for housing remains:

- Mortgage interest rates

- Insurance premiums

- Local taxes and fees

Education Spending

The plan includes $30.6B for K–12 education and $9,406 per student.

School quality affects:

- Family buying decisions

- Rental turnover and stability

- Pricing pressure in top school zones

School boundaries can raise or lower home values faster than most renovations.

Transportation and Housing Demand

$14.3B is proposed for the state's transportation work program.

New roads change housing markets. Commute times influence:

- Rent prices

- Buyer decisions

- Neighborhood momentum

Improved access tends to hold up demand. Poor access areas soften first.

Water Projects and Homeownership

The budget includes major funding for water quality and Everglades projects.

This can impact housing through:

- Utility upgrades tied to assessments

- Septic-to-sewer conversion mandates

- Permitting tied to drainage standards

- Buyer preference for less flood-prone areas

Drainage issues become market issues when it rains hard. If you're dealing with storm damage or flood-related property issues, these budget changes can directly impact your situation.

Government Efficiency and Sales Impact

The budget mentions staffing cuts and a push for efficiency.

For sellers, staffing changes affect:

- Permit processing

- Inspection timelines

- Recording and closing speed

- Response times to compliance issues

Delays increase sale risk. Speed helps clean deals close faster. If you need to sell your house fast in Florida, understanding these timelines matters.

What Florida Homeowners Should Do

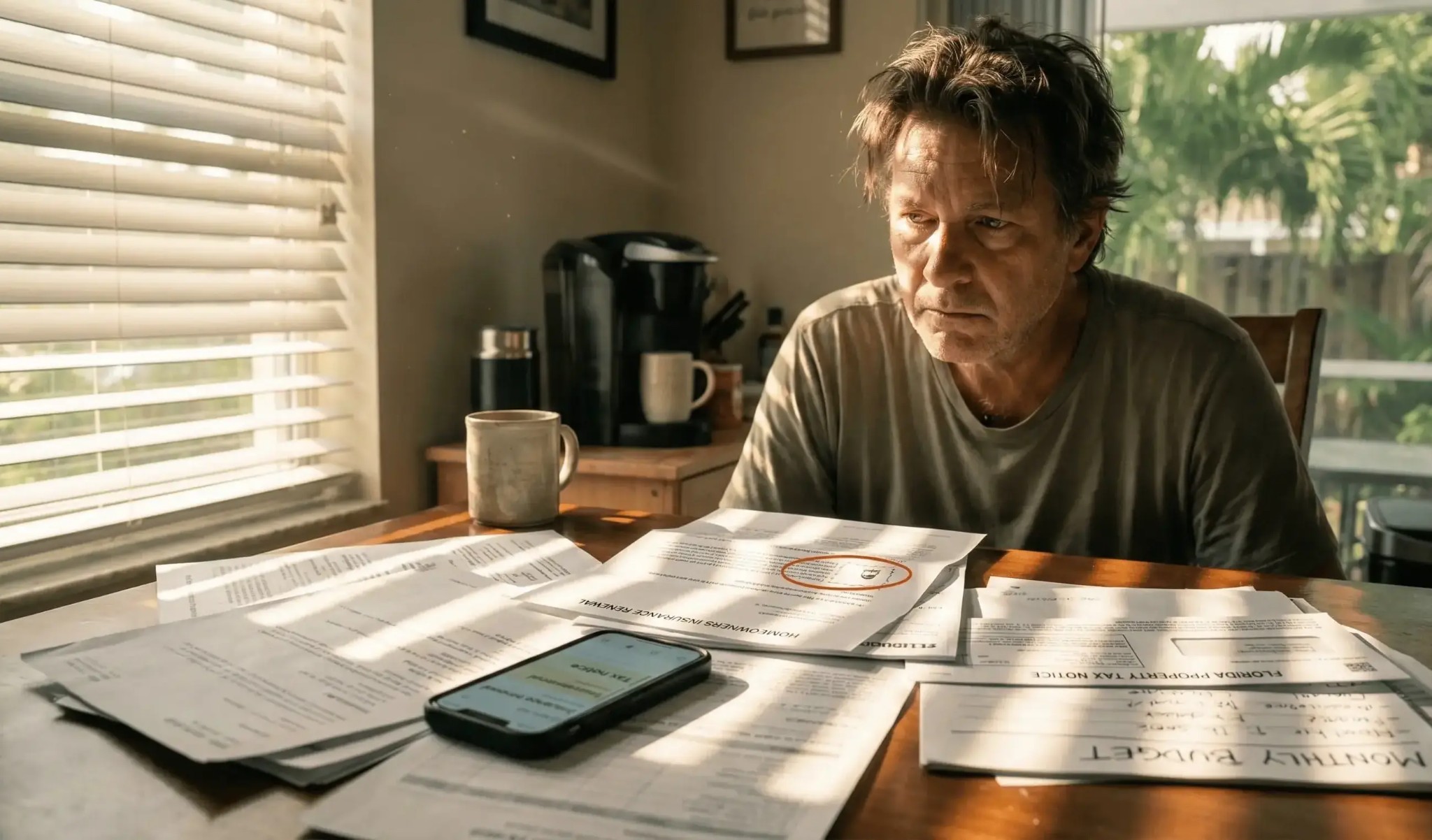

If You're a Homeowner Feeling Pressure

Run your real monthly number:

- Mortgage

- Escrow

- Insurance

- HOA

- Repairs

If it's rising faster than income, don't wait for state relief. Tired of being a landlord? You're not alone.

Quiet triggers that push sales:

- Insurance cancellation

- Escrow spikes

- Roof or plumbing issues

- Flood claims

- Assessments

If you're facing foreclosure or need to sell quickly due to financial pressure, understanding your options is critical.

If You're a Landlord

Write down key dates for the next 12 months:

- Lease expirations

- Insurance renewals

- Property tax notices

- Deferred maintenance

Ask one question: If rent stays flat, do I still want this house?

If not, sell before trouble surfaces. Many landlords are selling now to avoid the squeeze.

If You Plan to Sell in 2026

Focus on your street, not the headlines:

- Local days on market

- Zip code price cuts

- Insurance issues with roof or flood zone

- Appraisal sensitivity tied to condition

That's your real market. See which Florida markets we buy in and get a sense of local conditions.

FAQ

Is the Florida 2026–2027 budget final?

No. It's a proposal announced on December 10, 2025. The Legislature must still pass it.

Will this budget lower my property taxes?

Not directly. The $300M set-aside is exploratory. Any actual savings depend on local implementation.

Will SHIP, SAIL, or Hometown Heroes change prices?

Yes, in certain segments.

Hometown Heroes may lift demand for starter homes.

SHIP and SAIL may add supply that eases rent pressure in specific areas.

Related Articles

South Florida Has Cooling Rents Going Into 2026

South Florida real talk on the 2026 squeeze: insurance and taxes climbed while rents cooled. See the data, who hurts first, and how to underwrite deals now.

Read more →How to Sell Your House Fast in Florida: 15 Questions Answered

Need to sell your house fast in Florida? Get answers to the 15 most common questions about selling quickly for cash, including how fast houses sell, where to find buyers, and what to expect.

Read more →Want a straight cash offer from a local buyer?

If you're feeling the pressure from rising costs and want to see what a quick, as-is offer looks like, send me the address. I'll show you exactly what I would pay and why.