Last updated: January 2026

Sell Your House With HOA Fees Owed in Florida

Last updated: February 2026

Behind on HOA assessments? Facing liens or foreclosure from your homeowners association? We buy houses with unpaid HOA fees and handle the debt at closing. No need to catch up on payments. Close in 14-30 days.

Get My Cash Offer

Understanding HOA Debt in Florida

Florida has more homeowners associations than any other state—over 48,000 HOAs and community associations managing nearly 9 million properties. If you own a home in an HOA community, you've agreed to pay assessments, and those obligations don't disappear if you fall behind.

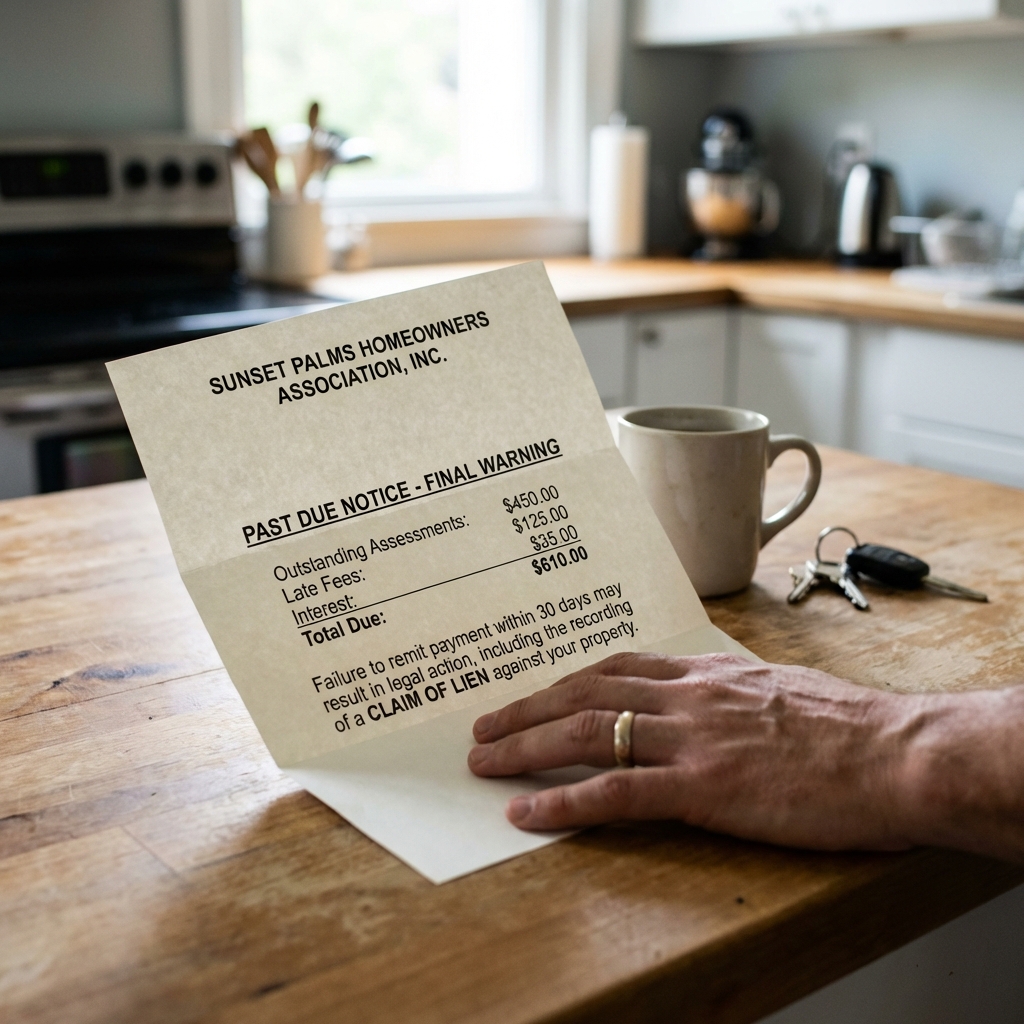

What starts as a few missed monthly payments can quickly escalate into a serious financial crisis. HOAs in Florida have significant power to collect debts, including the ability to place liens on your property, add substantial fees and attorney costs, and ultimately foreclose—even if you're current on your mortgage.

HOA Debt Grows Fast

A $300 monthly HOA fee can become $10,000+ in debt within a year once late fees, interest (up to 18% in Florida), and attorney costs are added. Many HOAs use aggressive collection tactics that dramatically increase your balance. Acting quickly is essential.

How HOA Debt Accumulates

Regular Assessments

Monthly, quarterly, or annual fees that cover common area maintenance, insurance, amenities, and reserves. Miss these and the clock starts ticking.

Special Assessments

One-time charges for major repairs, improvements, or reserve fund shortfalls. These can be thousands of dollars with little warning, especially in older communities and condos.

Late Fees & Interest

Florida allows HOAs to charge interest up to 18% per year on unpaid balances, plus late fees. These add up quickly and compound your debt.

Attorney & Collection Fees

Once your account goes to the HOA's attorney, expect thousands in additional fees. Florida law allows HOAs to pass these costs to you, often doubling or tripling your balance.

Fines & Violations

Unpaid fines for property violations (paint color, landscaping, parking) can be added to your assessment account and become lien-able debt in Florida.

Lien Recording Costs

When the HOA records a lien against your property, they add recording fees, title search costs, and additional attorney fees to your balance.

Can an HOA Foreclose in Florida?

Yes. Florida is one of many states that gives HOAs powerful collection tools, including the right to foreclose on your property for unpaid assessments. This is called a "lien foreclosure" and is completely separate from your mortgage. Your HOA can foreclose even if you've never missed a mortgage payment.

How HOA Foreclosure Works in Florida

- Delinquency Notice: After you miss payments, the HOA sends notice of the debt and gives you time to pay.

- Intent to Lien: Florida law requires 45 days written notice before recording a lien. This is your warning.

- Lien Recorded: The HOA files a Claim of Lien in the county public records, attaching the debt to your property.

- Foreclosure Filed: If the debt remains unpaid, the HOA can file a foreclosure lawsuit. This is serious legal action.

- Judgment & Sale: If you don't respond or lose, the court can order your property sold at auction to satisfy the debt.

The Timeline Is Shorter Than You Think

Unlike mortgage foreclosure, which can take years in Florida, HOA foreclosure can move much faster. Some aggressive associations begin the process after just 90 days of non-payment. Once attorney fees start adding up, your options narrow quickly.

Priority of HOA Liens

In Florida, HOA liens are generally subordinate to first mortgages but superior to second mortgages and most other liens. However, if the HOA forecloses, they can take title to the property subject to the first mortgage. This complexity makes HOA lien situations particularly stressful.

Even if you're underwater on your mortgage, you may still have equity in the sense that selling to a cash buyer and paying off both the mortgage and HOA debt gets you out cleanly—versus losing the property to foreclosure with damaged credit.

Selling Your Home When You Owe HOA Fees

Good news: you can absolutely sell your home even if you owe HOA fees. The debt doesn't prevent the sale—it just needs to be addressed at closing. The HOA lien is paid from your sale proceeds, similar to how your mortgage gets paid off.

The Estoppel Letter Process

When selling any property in an HOA, Florida law requires an estoppel letter—an official statement from the HOA showing exactly what you owe. This document tells the title company how much to pay at closing to clear the lien. Key points about estoppel letters in Florida:

- HOAs have up to 10 business days to provide an estoppel letter (15 business days if documents must be retrieved from off-site)

- The HOA can charge a fee for the estoppel letter—typically $100-$350

- The estoppel amount is binding on the HOA for 30 days from issuance

- All amounts in the estoppel—past dues, late fees, interest, attorney fees—must be paid to close

What If the Estoppel Shows a Huge Balance?

If your HOA debt has grown to tens of thousands of dollars, selling traditionally becomes challenging. The debt eats into your proceeds, and if you owe more than the home is worth after the HOA payoff, you may face a short sale scenario. Cash buyers like FL Home Buyers evaluate the full picture and can often still make purchases work.

Special Assessment Complications

Special assessments add complexity. If your condo association has levied a $50,000 special assessment for building repairs (common after Florida's new condo safety laws post-Surfside), that amount shows on the estoppel and must be addressed. Some buyers will negotiate to split special assessments; cash buyers typically handle them entirely.

| Factor | Traditional Sale | Cash Sale to FL Home Buyers |

|---|---|---|

| Timeline | 2-4 months minimum | 14-30 days |

| HOA Payments Continue? | Yes, until closing | Minimal time |

| Buyer Financing Issues | High risk (liens scare lenders) | None |

| Agent Commissions | 5-6% | 0% |

| Closing Costs | You pay | We pay |

| Certainty of Close | ~60% | ~98% |

How FL Home Buyers Handles HOA Debt

We purchase properties with HOA liens regularly and know exactly how to navigate the process. Here's how we make it simple:

Contact Us

Tell us about your property and HOA situation. If you know your approximate balance, share it—but don't worry if you don't have exact figures yet.

Property Visit

We visit within 24-48 hours to evaluate the property. We'll also request the estoppel letter to get exact HOA figures.

Cash Offer

We make you a cash offer that accounts for the HOA debt. Our offer is what you'll actually receive—the HOA payoff happens separately at closing.

We Handle the Debt

At closing, we pay off the HOA lien directly. You don't deal with them anymore. You receive your clean proceeds, and the HOA issue is resolved.

Real Example: Miami-Dade Condo HOA Debt

A condo owner in Kendall fell behind on HOA payments after job loss. Between regular assessments, a $15,000 special assessment for building repairs, late fees, and attorney costs, the debt had grown to $28,000. Traditional sale wouldn't work—after 6% commissions and closing costs, she'd owe money at closing.

She contacted us, and we evaluated both the property value and the total debt picture. We made a cash offer that gave her $42,000 in proceeds after the HOA was paid off.

Result: Closed in 23 days. She walked away with money in her pocket instead of owing more, and the HOA stopped all collection activity once our contract was in place.

Florida Condo Safety Law: SB 4-D and Special Assessments

In the wake of the tragic Champlain Towers South collapse in Surfside in 2021, Florida enacted sweeping new condo safety requirements. Senate Bill 4-D requires all condominiums over three stories to undergo structural inspections and maintain adequate reserves for repairs. For many condo owners, this has meant massive special assessments.

Under the new law, condo associations can no longer waive or reduce reserve funding for major structural components. Buildings must complete Milestone Inspections when they reach 25 or 30 years old (depending on proximity to the coast), and again every 10 years thereafter. When inspections reveal needed repairs, associations must fund them—often through special assessments that can reach $50,000, $100,000, or more per unit.

Impact on Florida Condo Owners

- Surprise Assessments: Many owners are receiving notice of five- and six-figure special assessments with limited time to pay.

- Unit Unsellables: Some units have become essentially unsellable traditionally because the pending assessment scares off financed buyers.

- Elderly Owners Hit Hard: Fixed-income retirees who bought condos decades ago often can't afford massive assessments.

- HOA Foreclosure Surge: Condo associations are foreclosing on units whose owners can't pay the special assessments.

- Insurance Issues: Some insurers are dropping buildings with structural concerns, adding to costs.

If you're facing a special assessment you can't afford, selling your condo may be the best option. Cash buyers like FL Home Buyers can purchase your unit and handle the assessment ourselves, giving you liquidity instead of foreclosure.

Tips for Dealing with HOA Debt

If you're behind on HOA payments or facing a large assessment, here are your options:

- Negotiate a Payment Plan: Many HOAs will work with homeowners who communicate proactively. Before the debt goes to attorneys, ask about payment arrangements.

- Ask for Hardship Consideration: Some associations have hardship policies. If you've had job loss, illness, or other circumstances, ask in writing.

- Understand the Timeline: Know when the lien recording deadline is and when foreclosure could begin. This helps you plan.

- Get the Exact Figures: Request an account statement or informal payoff figure. Knowing the real number helps you make decisions.

- Consider Selling: If the debt is substantial and growing, selling before it gets worse may net you more money than waiting.

- Consult an Attorney: If you're facing foreclosure, a real estate attorney can advise on your specific rights and options.

The worst thing you can do is ignore HOA debt and hope it goes away. It won't—and delaying only adds more fees and interest to your balance.

Frequently Asked Questions About Selling With HOA Debt

Can you sell a house with unpaid HOA fees in Florida?

Yes, absolutely. You can sell your home with unpaid HOA fees. The debt is settled at closing from the sale proceeds. The HOA lien gets paid off, and you receive the remaining proceeds. Cash buyers like FL Home Buyers handle these transactions regularly.

Can an HOA foreclose on my house in Florida?

Yes. Florida law allows HOAs to foreclose on properties for unpaid assessments after recording a lien. This is separate from your mortgage—the HOA can foreclose even if your mortgage payments are current. HOA foreclosures can move faster than mortgage foreclosures.

How much can HOA fees add up to?

HOA debt can grow shockingly fast. Between regular assessments, special assessments, late fees (up to $25-50 per occurrence), interest (up to 18% annually in Florida), and attorney fees (often $2,000-5,000 or more), debt can reach tens of thousands of dollars in a year or two.

Will you pay off my HOA debt at closing?

Yes. When you sell to FL Home Buyers, we handle all HOA liens and arrears at closing. The title company pays the HOA directly from the sale proceeds based on the estoppel letter. You receive your net proceeds after all debts are cleared.

What is an estoppel letter?

An estoppel letter is an official statement from the HOA showing exactly what you owe, including assessments, fees, fines, interest, and attorney costs. It's required for any property sale in a Florida HOA. The amount stated is binding on the HOA for 30 days.

How fast can you close on a house with HOA liens?

We can typically close in 14-30 days. The main timeline constraint is getting the estoppel letter, which Florida law allows HOAs up to 10-15 business days to provide. Once we have that, closing can happen within days.

What about special assessments?

Special assessments are included in the estoppel and paid at closing like regular assessment arrears. If your condo has a large special assessment pending (common after Florida's new condo safety requirements), we factor this into our offer and handle it entirely.

Can I sell if the HOA already filed foreclosure?

Yes, in most cases. Until the foreclosure is finalized, you still own the property and can sell it. Selling stops the foreclosure, pays off the HOA, and lets you walk away clean. We've purchased many properties with pending HOA foreclosure cases.

Florida Real Estate Law

Reference: Florida Statutes §689 (Conveyances)

- Florida law requires full disclosure of known defects under §689.25 — as-is sales to us eliminate your disclosure risk.

- Florida has no state income tax, which can be advantageous when structuring a quick sale and relocating.

- Title insurance is required by Florida law for all real estate transactions to protect both buyer and seller.

- We close with a licensed Florida title company that handles all paperwork, payoffs, and recordings.

Get Your Cash Offer Today

Stop worrying about HOA debt. Get a no-obligation cash offer and we'll handle the liens at closing. Close in 14-30 days.

Get Your Cash Offer

Tell us about your property and HOA situation. We'll give you a fair cash offer within 24 hours.

We Handle This Situation in Every Florida County

See local market data and get a fair cash offer in your county: